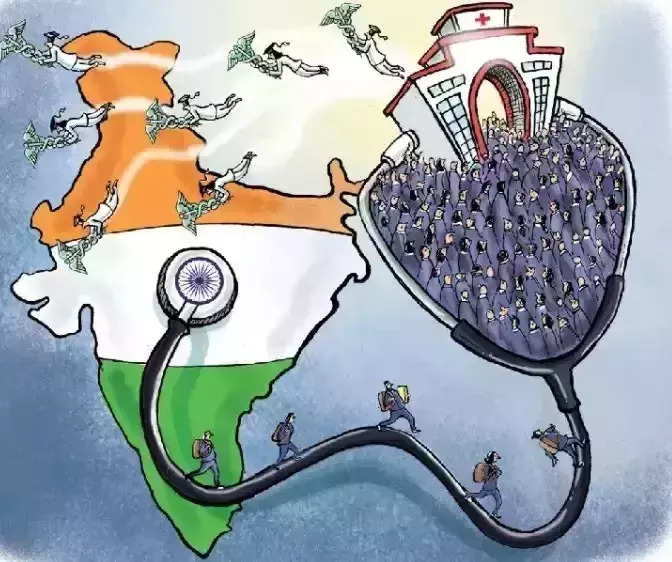

New Delhi: India’s healthcare challenge is not just about rising costs—it’s about crafting a system that balances sustainability, access, and equity. As the country grapples with growing healthcare demands, systemic inefficiencies, and budgetary constraints, prominent stakeholders are calling for bold, multi-pronged reforms. As India’s public health schemes expand and private players dig deeper while widening their reach, the need for stronger regulation, innovative insurance models, incentivized investments in underserved areas, and a decisive shift from sickness to wellness has never been more urgent.Healthcare leaders are sounding the alarm, articulating that one-size-fits-all solutions for healthcare sector won’t cut it anymore. What’s needed are multi-layered reforms that align incentives with outcomes and match investment with real needs. At a recent high-level webinar organized by ETHealthworld on the topic: Is the Surge in Private Hospitals Making India’s Healthcare Unaffordable?, leading voices from the industry stated that it is not a single-threaded issue. It is embedded in a complex web of legacy underinvestment, fragmented governance, skewed incentives, and rising consumer expectations. But signs of progress are visible—from new-age care delivery models to payers and providers joining forces to build frameworks around value and transparency. What emerges is a hopeful yet urgent call: India doesn’t just need more healthcare—it needs smarter healthcare.The discussion began by highlighting the glaring disparity between government-mandated rates under PM-JAY and what private hospitals in metros charge for the same procedures. For instance, dialysis under PM-JAY is priced at ₹1,500, whereas private hospitals charge ₹2,500–₹5,000. Similarly, coronary angioplasty is reimbursed at ₹40,600 under the scheme but can cost anywhere between ₹66,000 to ₹2,15,000 in private facilities. This chasm poses a serious challenge to middle-income families across the country. The glaring gap leaves out millions from the grand vision of making healthcare affordable to all.

Answering this, C.K. Mishra, IAS, Former Union Secretary, MoHFW and Former Union Secretary for Environment, Forests and Climate Change, Government of India, said, “This is a question many grapple with, often trying to arrive at their own answers. The reality is that healthcare provisioning in the private sector in India is quite expensive, and the services provided by large hospitals are often out of reach for the common man. That said, it’s not fair to compare schemes like PM-JAY with private healthcare services. Interestingly, many private hospitals admit they use their regular paying patients to cross-subsidize treatments under PM-JAY or CGHS.”

That is when most leading hospitals in cities have opted out of the scheme citing various reasons like the mismatch in the rates and long delays in getting reimbursed.

Besides, Mishra highlighted systemic gaps—particularly the underinvestment in public health infrastructure—as a driving force behind the increasing dependence on costlier private healthcare. He candidly said, “The investment the government was meant to make in public healthcare has not kept pace with actual needs, forcing people to turn to costlier private facilities. Universal insurance is still a distant goal.” In his view, the need is to suitably ramp up the healthcare budget.

The Financing Shift and Hospital Market Segmentation

Offering a macroeconomic perspective, Dr. Prem Pavoor, Managing Partner & Head of India Ventures at global venture capital firm, Eight Roads, said, “Around 70 per cent of hospital capex in India has typically come from the private sector, while the government has contributed about 30%. Recently, we are seeing a notable shift. The government appears to be moving toward a model similar to that of the United States, playing the role of a payer through schemes like Ayushman Bharat rather than being both a provider and a payer.”

He pointed out that despite rising hospital charges, Ayushman Bharat has played a transformative role in expanding access. “Healthcare stands out as the only sector in India where private equity investments have doubled post-COVID. A great example is the Ujala Cygnus chain co-founded by Dr. Suchin Bajaj, which has effectively leveraged Ayushman Bharat to deliver affordable healthcare.”

Noting that the hospital ecosystem is maturing into distinct models, Dr. Pavoor said, “What we’re seeing now is a clear segmentation… In parallel, we’re witnessing the emergence of new players in smaller cities—often evolved from nursing homes—geared towards delivering mass, affordable care… Over the next three to four years, I believe we’ll see this ecosystem mature further.”

A New Model: Low-Cost, High-Volume Care

Dr. Shuchin Bajaj, Founder, Ujala Cygnus Hospitals, who has built his healthcare philosophy around accessibility with number of affordable care hospitals in smaller cities, said, “Our effort has been to flip the traditional private healthcare model on its head. We have been working to reverse that—to move toward a low-cost, high-volume model. Schemes like PM-JAY definitely help in that direction.”

Bajaj, who is also a vocal critic of the fee-for-service model, said, “It fundamentally misaligns incentives between doctors and patients. If a patient has a heart attack and comes to me, my incentive under fee-for-service is to treat it. But the patient’s real incentive is to not have that heart attack in the first place.”

Stressing that the true cost of illness extends far beyond hospital bills, Dr. Bajaj profoundly said, “The true cost includes lost wages, the inability to work, children being pulled out of school to support the family… We need to look at the full picture—from prevention to infrastructure to access and long-term societal costs.”

Infrastructure Bottlenecks and Rising Input Costs

Dr. K Madan Gopal, Health Policy Expert and Former Advisor, NITI Aayog, explained that as incomes rise, so do healthcare costs. “But the pace at which both are rising is not always in sync… We currently need around 42 lakh hospital beds to cater to India’s inpatient care needs. In reality, we have about 19 lakh beds,” he added.

“This shortfall has driven private sector expansion, especially in tier 2 and tier 3 cities. But that comes with challenges. Private providers must invest in advanced technology… bringing in new technology significantly raises the cost of care. The cost of acquiring a patient is roughly 30%—and that cost is passed on to the patient,” Dr. Gopal said.

Highlighting other significant cost drivers, including salaries, accreditation standards, and land costs, he said, “Land consumes about 25% of the capital expenditure… hospitals pay commercial rates for electricity, which is a major expense. Although ‘industry status’ was granted to healthcare in the 2017 Budget Speech, the benefits are still pending full implementation.”

Dr. MadanGopal also emphasised the need for price transparency and self-regulation. “One recurring suggestion is the need for self-regulation. If hospitals or their associations proactively set cost benchmarks… it may help prevent heavier-handed government intervention later.”

Where Do We Go From Here?

While panelists were questioned on how India’s healthcare ecosystem is undergoing dramatic transformation—venture capital is flowing, hospitals are expanding into smaller towns, and digital awareness is empowering patients—one pressing question looms large: Is healthcare still affordable for the average Indian?

On one hand, there’s a push for accessibility, but affordability remains a serious concern—an issue echoed across the sector. With a surge in private sector investments, especially in smaller cities, the question arises—how will these projects deliver a return on investment, particularly when reimbursement challenges persist under public health insurance schemes like Ayushman Bharat?

Commenting on this and noting a distinct shift in patient behavior, Dr. Pavoor said, “The smartphone has significantly bridged the information asymmetry between patients and doctors. Today, patients arrive for consultations already having researched their conditions online. They seek second opinions, compare healthcare providers, and make informed choices based on price and perceived quality.”

This newfound awareness, coupled with rising insurance coverage, has led to a wave of healthcare investments—both large and small. But Dr. Pavoor added a note of caution: “With the volume of capital that’s come in, competition is intensifying. Every provider is now targeting the same patient, which will naturally bring pricing pressures.”

Dr. Pavoor was of the view that while the rates for treatment is spiralling in the cities, over a few years there will be a correction since every hospital will vie for the same patient and the final choice will be with the patient.

Middle-Class Squeeze: A New Vulnerability

We are no longer just talking about affordability challenges among the low-income population—healthcare has become unaffordable even for those in the middle and upper-middle income brackets. When panelists were asked whether the Clinical Establishments Act, intended to bring transparency to pricing, had made any real impact:

Taking a very critical stance, C.K. Mishra said, “Very few states have adopted the Act, and those that did have largely done nothing to implement or enforce it. Forget rate boards—in many cases, patients don’t even know the estimated cost of their treatment until they are discharged. That level of opacity is unacceptable.”

Mishra, known to be an avid follower of trends in the healthcare industry therefore warned, “If the sector continues to remain non-transparent, it will inevitably invite regulatory intervention. At that point, hospitals will have no moral ground to resist.”

But Mishra also called out a deeper systemic flaw—India’s over-reliance on tertiary care. “We are building a sick-care system—reactive and treatment-oriented. As long as this imbalance persists, the cost of treatment is unlikely to come down.”

The Rural Dilemma: Cost, Quality, and Capital

Dr. Shuchin Bajaj didn’t sugar coat the challenges either. He noted, “Attracting high-quality doctors, nurses, and bringing in the best technology into smaller towns is no easy task. All hospitals, regardless of location, must be NABH-accredited and offer clinical outcomes that are at par—if not better—than those in bigger cities.”

Exposing a common myth, he said, “We have even seen policies where government schemes pay higher reimbursement rates to big-city hospitals than to those in small towns. That’s based on a myth—that it’s cheaper to run a hospital in a smaller town. Let me say this clearly: it is not.”

Calling for strong government support to expand healthcare reach, Dr. Bajaj said, “If government policies are seen to support and publicly reward these high-performing institutions—even if they sometimes err on the side of overpaying them—that’s fine. Those are the kinds of ‘errors’ we can live with.”

The Shift from Provider to Payer: A Double-Edged Sword

Another significant concern on transformation of CGHS (Central Government Health Scheme) into a referral mechanism that channels patients to private hospitals, often with limited oversight, was asked to panelists.

Dr. Bajaj pointed out that the root causes of healthcare issues were not being addressed and instead, the system was increasingly moving toward a sick-care model. He mentioned that with a fee-for-service structure in place and the government transitioning from being a provider to a payer, such issues were likely to persist.

Highlighting a dangerous trend, he said, “General practitioners (GPs)—the backbone of preventive care—are fast becoming a vanishing breed. Most MBBS graduates today don’t want to practice as GPs… they aim to become super specialists, often drawn by the promise of playing with the latest technology and earning more.”

CGHS: A Misplaced Litmus Test?

“First and foremost, this overemphasis on CGHS is a bit misplaced,” said Mishra. “We’re talking about a relatively small population of central government employees—they cannot be the benchmark for assessing whether India is progressing in the health sector.”

While CGHS payouts have increased dramatically, Mishra attributed this to a spike in private hospital referrals and the clearing of longstanding dues—underscoring systemic distrust in public hospitals. “Neither patients nor doctors have confidence in public facilities, and that’s the real tragedy,” he noted.

His bold suggestion? Rethink India’s four-tiered healthcare model and experiment with GP-led models where general practitioners are accountable for specific populations—systems proven effective globally but yet to be adopted meaningfully in India.

Dr. MadanGopal agrees that CGHS today is trapped in a legacy model, ill-equipped to serve its ageing and comorbid population. The real issue, he suggests, is structural: “Many CGHS beneficiaries have private insurance but still don’t receive the quality or timeliness they expect. That speaks volumes about inefficiencies.”

He recalls an initiative to integrate CGHS with Ayushman Bharat (PM-JAY) for cost rationalization—a proposal that failed to take off. His prescription is simple but impactful: “Build annual health check-ups into CGHS—for employees and their families. Early detection can reduce ballooning treatment costs.”

Public vs Private: Are We Finding the Right Balance?

On whether India has reduced the financial burden on its citizens, Dr. MadanGopal points to encouraging indicators: “Out-of-pocket expenditure has dropped to under 40 per cent, and that’s a milestone. But health inflation is rising, and so is household expenditure on care.”

He credits initiatives like free diagnostics, Jan Aushadhi, and the massive investments under the PM-Ayushman Bharat Health Infrastructure Mission for helping to build a more resilient public system. Still, he cautions, “We’re in a race against scale. Infrastructure is expanding, but so is demand.”

Meanwhile, Dr. Pavoor believes the healthcare investment landscape is undergoing a quiet revolution. “We are finally at a stage where the conversations have matured—from fragmented primary care models to integrated, outcome-oriented care ecosystems,” he says.

“Before Ayushman Bharat, we weren’t even talking about universal health coverage. Now, we are moving toward value-based care and closed-loop systems,” he adds, referencing global models like Kaiser Permanente and community-centric care pilots such as Iora Health in the US.

He warns of the risks of profit-first models, stating, “Patient outcomes in PE-funded US hospitals have been worrying,” but remains optimistic about the Indian trajectory. Niche investments in outpatient care, integrated platforms, and tech-led models are gaining traction.

“Even impact investors want sustainability,” he adds. “And in India, that path may just lie in well-designed, technology-enabled ecosystems.”

The panelists made it clear: if India is to emerge as a truly inclusive healthcare power, accessibility alone won’t be enough. Affordability must be protected, transparency must be enforced, and investments must support not just business goals but healthcare outcomes.

While C.K. Mishra reiterated, “What India truly needs is healthcare, not just a health business. That distinction must remain clear,” Dr. Bajaj added, “If the intent is real, the impact will follow.”

The consensus among healthcare leaders is clear: India’s healthcare future hinges on systemic integration, preventive care, and trust-building in public systems. While initiatives like Ayushman Bharat have laid the foundation, it’s the next wave—rooted in value-based, GP-led, tech-integrated models—that holds the promise of real transformation. It’s time to stop patching old frameworks—and start building healthcare for India of 2047.